iBuyer Market Share Plummets, With a Measured Recovery Ahead

/Like many businesses, iBuyers took a significant hit during the pandemic. Home purchases dropped 90 percent as the major iBuyers paused their operations, and as they come back to life, the iBuyers are rebounding cautiously and slowly, suggesting a long road to pre-pandemic levels.

Purchases Down 90 Percent

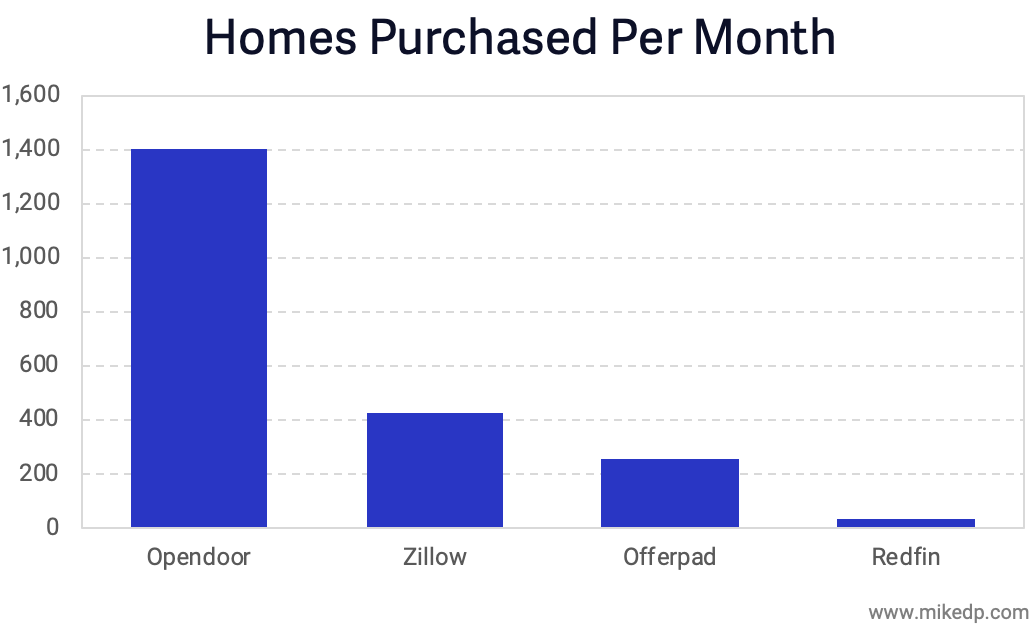

With the pandemic and associated lockdowns earlier in the year, iBuyer purchase volumes plummeted 90 percent. The major iBuyers (Opendoor, Offerpad, Zillow, and Redfin) paused new home purchases in March, citing safety concerns, before resuming operations in May.

With a gradual recovery in purchases throughout the remainder of 2020, total iBuyer purchases for the year could be half that of 2019.

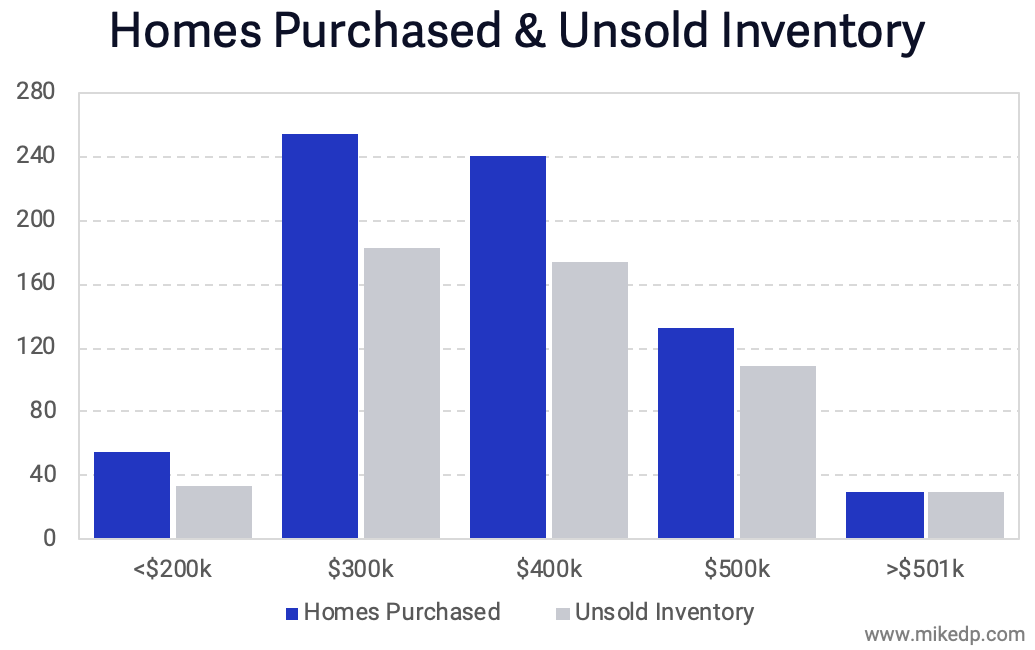

Pausing new home purchases didn't stop the iBuyers from selling thousands of homes in inventory during the lockdown. In May, iBuyers only purchased 200 homes but managed to sell over 1,700, a clear sign they were trying to clear their inventory as quickly as possible. The pandemic stopped iBuyers from purchasing homes, but it didn't stop them from selling homes.

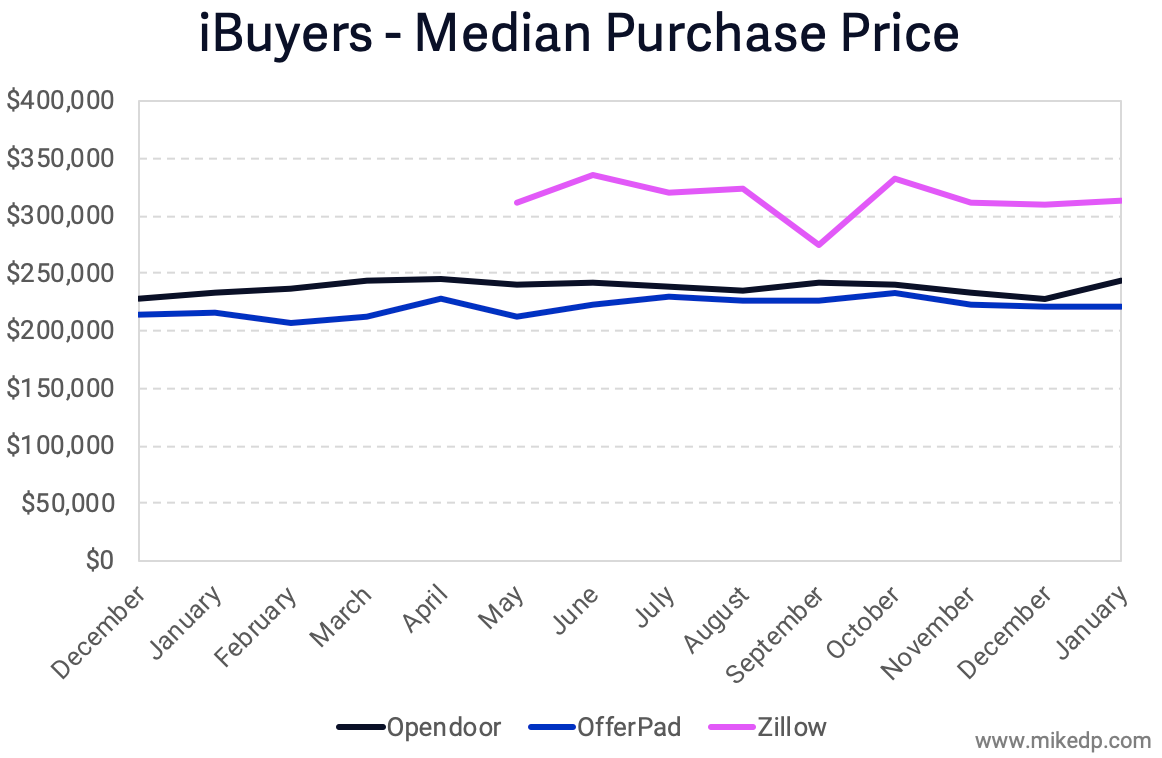

After announcing a resumption of purchases in May, all of the iBuyers have slowly ramped up their operations -- but at different velocities. In June, Zillow purchased around 50 homes, Opendoor about twice as many, and Offerpad about three times as many. The ramp up in activity is slow.

A Slow and Measured Recovery

iBuyer purchase volumes are recovering much more slowly than the overall markets they operate in. For example, in Phoenix, the overall market has recovered to pre-pandemic transaction levels. But iBuyer market share of that volume is still well below pre-pandemic levels.

The data suggests that iBuyers are taking a slow and measured approach to ramping up purchases. Many U.S. markets are hot: low inventory, massive buyer demand, and rising prices -- not a great environment for iBuyers.

Total iBuyer purchases across their top five markets are still a fraction of what they were earlier in the year.

Strategic Implications

The pandemic has put the iBuyer business model -- along with countless other businesses -- under strain. The past few months has seen them pivot and adapt, by launching traditional brokerage services, increasing agent referral fees, and Opendoor partnering with leading portal realtor.com.

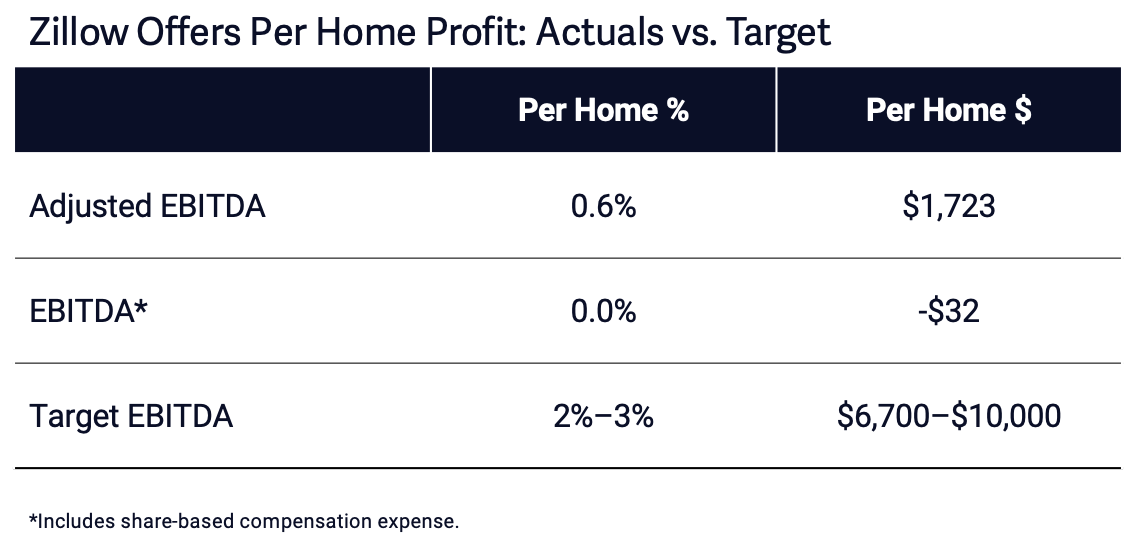

The iBuyers are back to buying houses, but the evidence suggests a more slow and cautious approach. And once the iBuyers prove they can survive the pandemic, they're still faced with the same challenge they had pre-pandemic: profitability.